Monticello, NY – Sullivan County’s independent auditors informed legislators Thursday that County government’s financial picture is improving, based on the results of their audit of the 2020 fiscal year.

“2020 was obviously an unorthodox year,” acknowledged Matthew Montalbo of Drescher & Malecki, a Buffalo-based accounting firm. “You did have to significantly reduce your expenditures really to even come close to a balanced budget in 2020.”

“Despite predictions by the State and others that we would be facing a terrible deficit, we did end up better at the end of the year,” County Treasurer Nancy Buck observed. “I credit that to County leaders making a number of hard decisions to stay in the positive amidst huge unknowns.”

The U.S. Department of Treasury estimated Sullivan lost about $10 million in revenue due to the COVID-19 pandemic during 2020, Montalbo noted, encouraging County leaders to focus on stabilizing the fund balance (surplus), with less reliance on it to maintain cash flow.

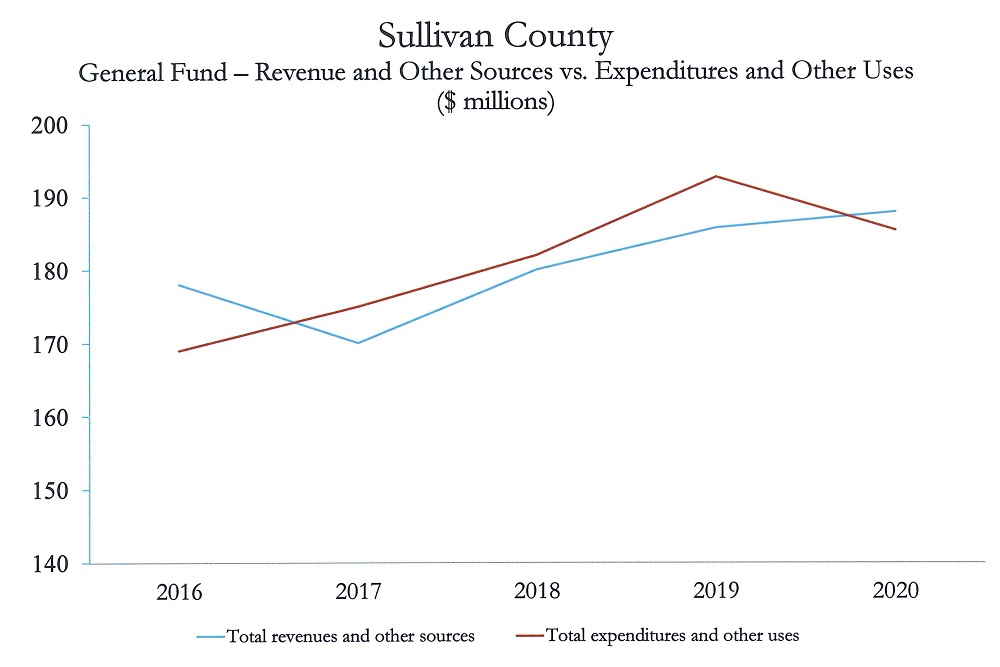

The audit, however, did show that the County’s revenues outpaced expenses in 2020, the first time in three years.

“I expect that trend to continue,” stated County Manager Josh Potosek after the meeting. “We’ve carefully monitored spending Countywide and zeroed in on finding revenue wherever we could. I’m pleased to see proof that this conservative approach is leading us toward a stable financial future.”

As a result of the good news, legislators that same day agreed to begin a promised rollback of the County’s existing residential Energy Tax. Some wanted to end it ahead of the February 2023 sunset date, but in the end, a 5-4 vote led to the 4% Energy Tax being dropped on oil, biofuel, kerosene, natural gas, propane and steam as of December 1, 2021 (applicable only to residential properties), pending State approval. The tax remains – for now – on electricity purchased for all home power purposes.

“This tax was created last year to provide the County with a buffer against the fiscal challenges brought on by the pandemic,” Potosek explained. “While we’re not yet out of the woods with COVID-19, our finances are moving toward stabilization, and the Legislature wishes to provide tax relief to the people of Sullivan County as soon as possible.”